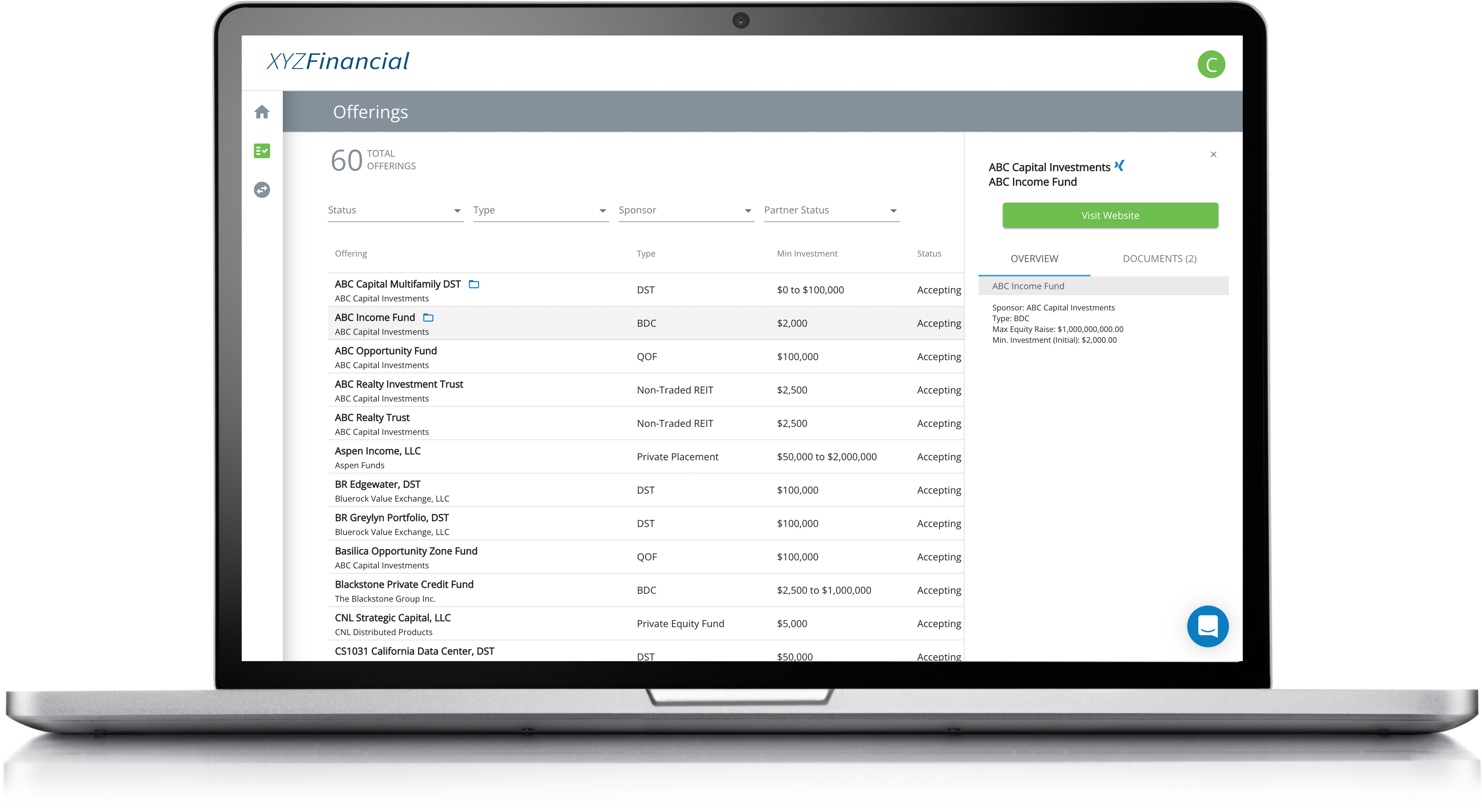

Offering Showcase

Access a wide variety of alternative investment opportunities with a searchable list of alts from 130 well-known sponsors*.

The SEI AccessTM platform allows client interactions to remain focused on financial goals and not tedious, error-prone paperwork. Our smart workflow combines electronic subscription documents, proprietary paperwork, custodian forms, and e-signature capabilities to help ensure speedy transaction processing with greater accuracy—the first time.

Save valuable time in your day. Pull in client data directly from your CRM or save data after entering once—allowing you to allocate a client to multiple funds in minutes.

Simplify your back-office with a digitized investment experience that includes data verification and business rules to reduce NIGO rework.

Save valuable time with an investment workflow that shows only the fields you need and does all the calculations for you. Plus, you'll be able to attach all required documents such as investor profile in one complete subscription package.

RIA Firms

Transactions

Transaction Volume

**SEI Access Platform stats as of 11.1.2024.

"I have been seeking a solution like SEI Access that allows me to conduct my alts business across all the fund managers and sponsors I work with, all in one place. I can sort and filter by sponsor, offering type and more, making finding exactly what I need fast and easy."

"After years of having to cobble together alternatives from various sources, I finally have an aggregated platform through which I can conduct all of my firm’s alternative investment business. SEI Access is fast, intuitive, and exactly the platform I was looking for.

"There are tech solutions out there for financial planning, portfolio management, CRM, and now for sourcing and allocating to alternative investments. If you’re an RIA looking to make your firm’s alts business as easy operationally as all your other business, I strongly recommend SEI Access."

***Clients quoted represent a cross-sample of firms using the SEI Access platform and were not compensated for providing their experiences. Their experiences and opinions are their own and may vary from other firms using the SEI Access platform.

Access a wide variety of alternative investment opportunities with a searchable list of alts from 130 well-known sponsors*.

Provide a single signing experience that includes firm, custodian and sponsor-required documents such as investor profile.

Save hours of work with an information collection workflow that pre-fills investor info, completes calculations and validates data in real time.

Track alternative investments in progress at-a-glance with an interactive dashboard detailing all activity of subscriptions “in flight”.

When entering investor information in SEI Access, data is encrypted and highly sensitive fields have a second encryption layer.

PII is accessible only by authorized personnel at your firm, the offering sponsor and select Sr. IT staff at SEI Access on an as-needed basis.

SEI Access' firewalls monitor network traffic and block unauthorized communications. Data is backed up and sent to cloud-based storage.

A member of the SEI Access team will be happy to walk you through the platform and answer any questions.